Sydney property prices could rise up to 9% next year

While 2022 began on a high for Sydney's property market with prices peaking in January, it’s been downhill ever since as successive interest rate rises took a toll on buyer demand.

By November, prices were down 11.4% from January, according to CoreLogic’s most recent home value index. Despite this slump, values remain 10.3% above pre-pandemic levels, such was the strength of the recent property boom.

What’s more, Sydney could stage a remarkable comeback over the next 12 months with Louis Christopher, SQM Research’s managing director, predicting home values in the city will rebound by up to 9% in his latest Boom and Bust Report.

Mr Christopher is one of Australia’s most respected property analysts with a strong track record of getting it right.

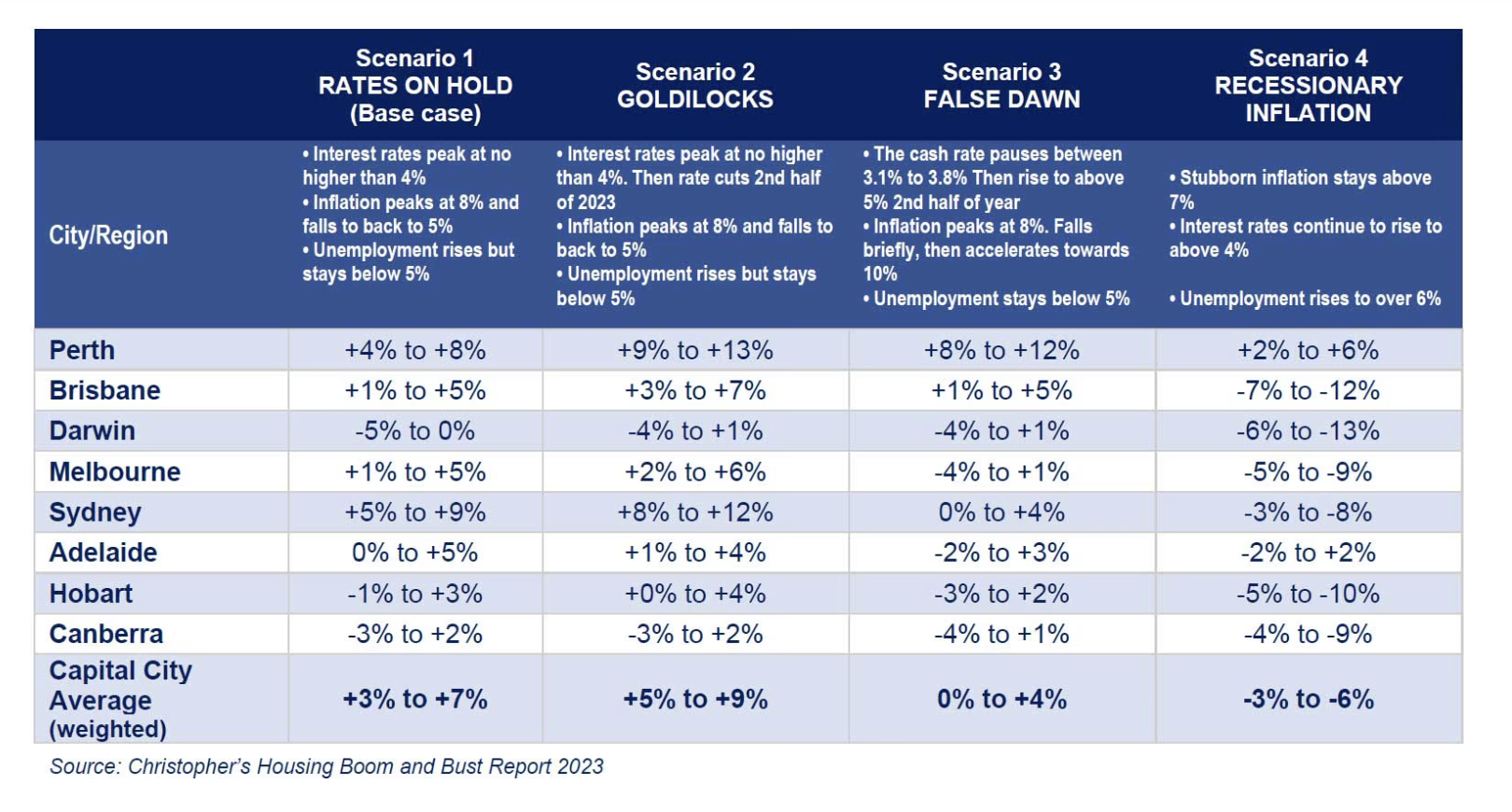

As you’ll see in the table above, this ‘base case’ forecast assumes three things.

The cash rate peaks no higher than 4% (which is in line with the big four banks' predictions)

Annual inflation hits a high of 8% before falling back to 5% (which is in line with the Reserve Bank of Australia’s expectations)

The unemployment rate stays below 5% (it was 3.5% in November)

So what will drive the recovery?

Mr Christopher said Sydney should see a surge in demand for residential property caused by:

Overseas migration

Workers returning to the office

A shortage of rental accommodation

The NSW government's recent stamp duty reform

Should you buy now … or wait?

Only time will tell if Mr Christopher’s forecast proves correct.

That said, the downturn in Sydney is showing signs of easing – with a 1.3% rate of decline in November compared to 2.3% in August.

And you could miss out if he does prove on the money – with a 9% increase adding over $92,000 to Sydney’s median home value in dollar terms.

It’s also a great time to be in the market for a new home (if your finances allow), with rising listing numbers and less competition giving buyers more power. As a result, properties are sitting on the market for a little bit longer – giving you more time to consider your options and making vendors more willing to negotiate terms.

Need a home loan? Eventus Financial is an award-winning mortgage broker in Sydney with over 340 five-star Google reviews. Schedule a no-obligation consultation with Alex to find out how we can help you too.