What’s causing Australia’s housing shortage?

In April 2023, just eight out of every 1000 rental properties across Australia were untenanted, the lowest point on record, according to Domain.

But while supply is ultra-low, demand is high, creating competitive conditions for would-be tenants. In turn, this is putting upwards pressure on rents, with CoreLogic's national dwelling rental index jumping 10.1% over the year to April – its fastest annual pace on record.

So it’s increasingly clear that, right now, there aren’t enough homes to rent in Australia. But you might be wondering what’s causing the shortage.

Construction rates aren’t keeping pace with demand

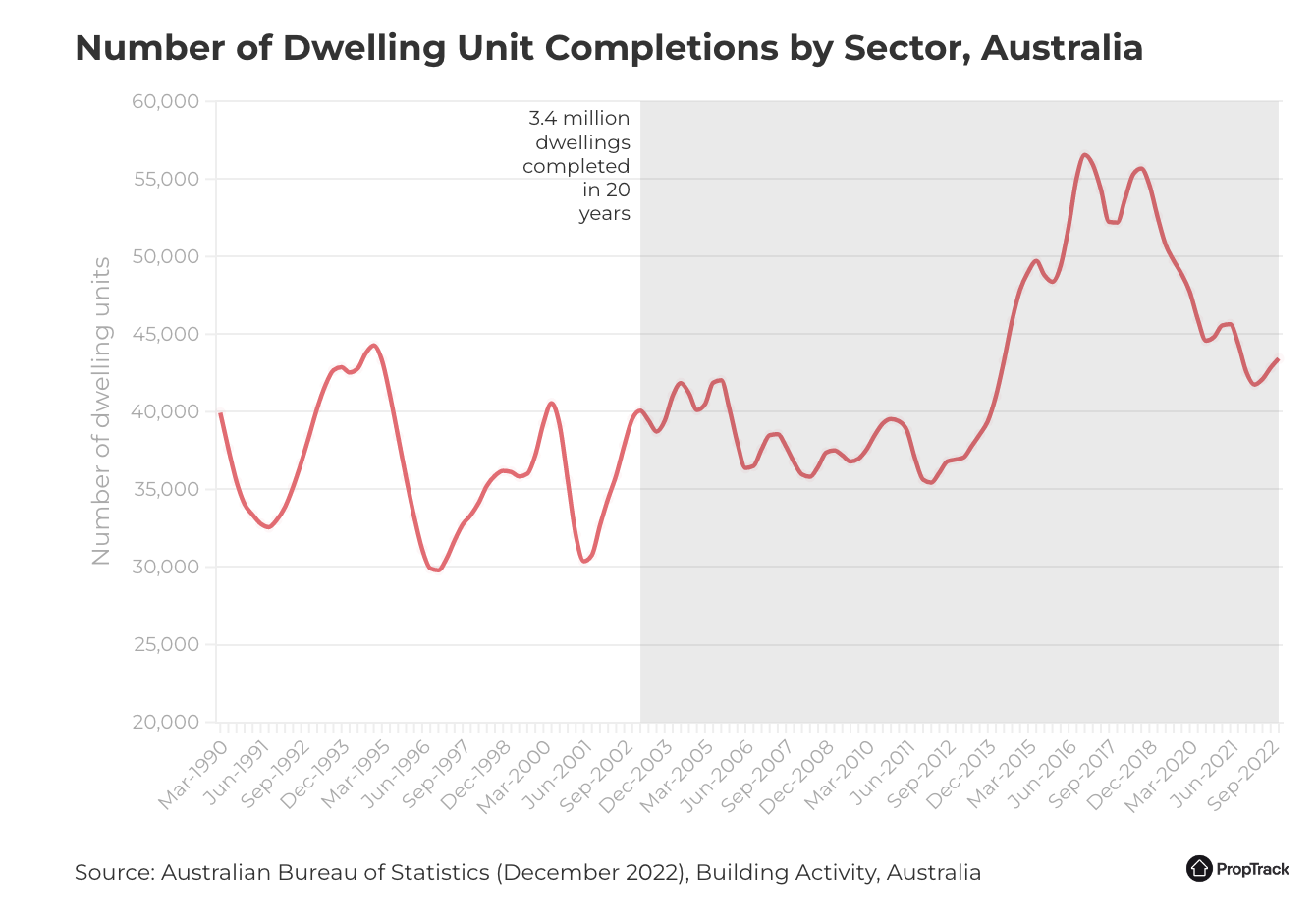

As the PropTrack graph below shows, Australia’s housing stock grew by 3.4 million dwellings in the two decades to December 2022.

That might sound like a lot … until you realise our population grew by 6.5 million people over the same period.

It’s this supply-demand imbalance that’s, ultimately, causing the housing shortage. The problem is unlikely to get fixed any time soon either, with the National Housing Finance and Investment Corporation recently estimating a nationwide shortfall of 106,000 homes over the five years to 2027.

Driving that shortfall is the rapid rebound in overseas migration, with the Centre for Population expecting net overseas migration to increase by 268,000 between 2022 and 2024.

These migrants will need somewhere to live, putting further pressure on the already-struggling rental market.

Compounding the problem are slowing construction rates, with the first quarter of 2023 seeing the lowest number of building approvals in more than a decade, according to the Housing Industry Association.

To make matters worse, an increasing number of development projects are getting shelved due to high construction and borrowing costs.

For instance, almost 16,400 dwellings in New South Wales were approved but not yet begun at the end of March, according to an analysis by KPMG Australia. That’s up from 13,800 at the same time last year.

Other impacts of the shortage

It’s not just Australia’s rental markets that will feel the pressure from slowing supply; home prices will too.

You can already see the beginnings of this playing out, with CoreLogic’s national home value index rising 0.5% in April, following a 0.6% lift in March, despite higher interest rates.

According to CoreLogic’s research director, Tim Lawless, the positive trend comes amid a worsening imbalance between supply and demand.

“A significant lift in net overseas migration has run headlong into a lack of housing supply. While overseas migration would normally have a more direct correlation with rental demand, with vacancy rates holding around 1% in most cities, it’s reasonable to assume more people are fast-tracking a purchasing decision simply because they can’t find rental accommodation,” he said.

Looking for an award-winning mortgage broker in Sydney? Eventus Financial has over 350 five-star Google reviews and a very strong reputation. Schedule a no-obligation consultation with Alex to find out how we can help you.