Sydney property market surges, led by Canterbury as falling interest rates fuel buyer demand

Sydney’s property market is showing renewed strength across multiple regions, with sharp monthly and quarterly gains recorded in August, according to Cotality.

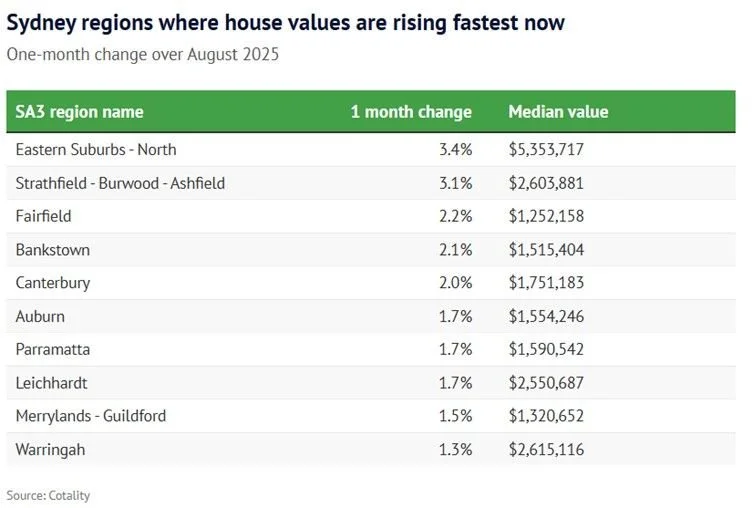

The Eastern Suburbs led the way with a 3.4% monthly rise – including standout gains in Bellevue Hill, Bondi Beach and Waverley – while values in the inner west region of Strathfield, Burwood and Ashfield increased 3.1%. Over the past three months, however, Canterbury has been the strongest Sydney property mover, up 6% to a median of $1.75 million.

Cotality’s head of research Eliza Owen said the lift reflected the impact of lower interest rates, which were helping a wider range of buyers compete.

“The reason we’re now seeing those high-end markets come back into the mix is that interest rate declines increase borrowing power disproportionately for middle and high-income households…By dollar value, you can get access to more money and so people try to buy further in and target the more expensive markets.”

Ms Owen told Domain this same influence was seen on the inner west market, bolstered by many new unit developments in anticipation of the Metro West which has made houses even more desirable.

About the author – Alex Veljancevski is a Sydney Mortgage Broker with Eventus Financial, which assists first home buyers, investors, upgraders and borrowers seeking to refinance to a better deal on their home loan.