Borrower confidence lifts as refinancing rises, but job security fears grow

Australian mortgage borrowers are feeling slightly more confident about their finances, with 34% now positive about their outlook – up from 32.5% in February.

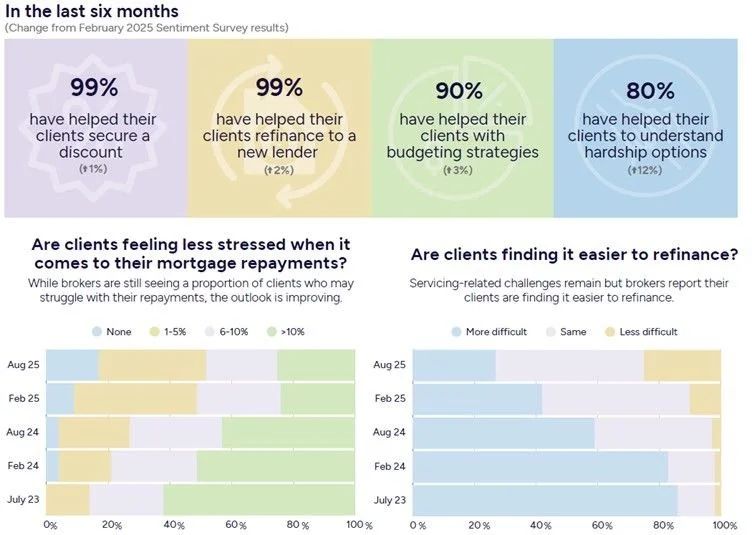

These findings from the Mortgage & Finance Association of Australia’s sentiment survey reflect how recent rate cuts, easing inflation and tax changes have supported household budgets.

That said, concerns about job security are rising. The share of clients reporting uncertainty about their employment jumped from 4.8% in February to 18.3% in August, making it the second highest driver of negative outlook after cost of living. Housing supply also remains a key issue.

Importantly, the survey shows more borrowers are now able to refinance, as serviceability pressures that previously kept many in mortgage prison have eased.

With refinancing activity doubling since February, households are increasingly able to access competitive interest rates and manage repayments more effectively.

About the author – Alex Veljancevski is a Sydney Mortgage Broker with Eventus Financial, which assists first home buyers, investors, upgraders and borrowers seeking to refinance to a better deal on their home loan.