RBA Holds Cash Rate at 3.60% as Inflation Pressures Re-Emerge

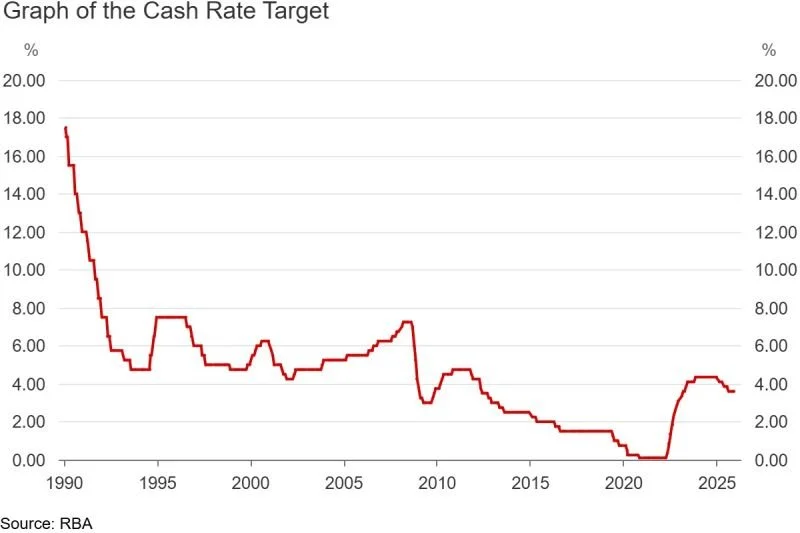

The Reserve Bank of Australia (RBA) has kept the cash rate steady at 3.60% at its December meeting, with the Board signalling a cautious approach as inflation shows early signs of picking up again.

While inflation has fallen sharply since 2022, recent data points to a more broadly based rise in prices. Annual trimmed mean inflation rose 3.3% in October, up from 3.2% the month before, heading in the opposite direction of the RBA’s 2-3% target range.

In its statement following its meeting, the RBA said it believes some of this increase may be temporary, but “it will take a little longer to assess the persistence of inflationary pressures”.

With momentum in the economy stronger than expected and uncertainty around global conditions, the RBA says it will be watching the data closely before shifting policy.

As a result, more rate relief for borrowers and home owners is likely still some distance away, with the RBA prioritising inflation control over near-term cuts.

About the author – Alex Veljancevski is a Sydney Mortgage Broker with Eventus Financial, which assists first home buyers, investors, upgraders and borrowers seeking to refinance to a better deal on their home loan.