Help to Buy Opens: New Shared-Equity Pathway for First Home Buyers

Applications have opened for the federal government’s Help to Buy scheme, marking a significant step for buyers who have struggled to bridge the final gap into property ownership, according to Housing Australia.

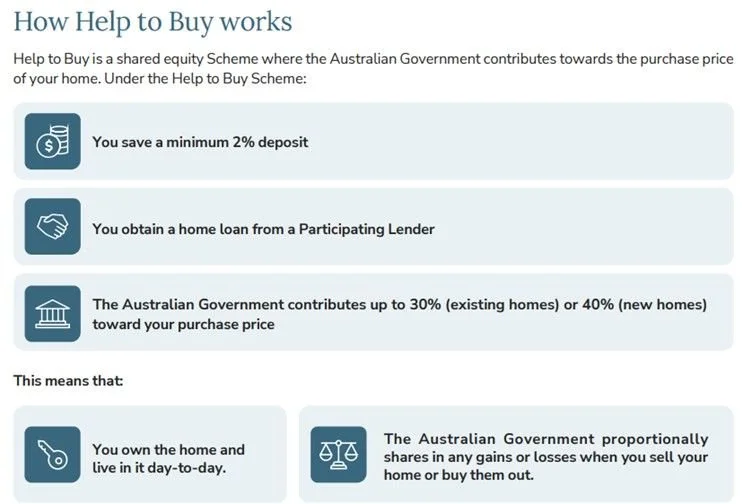

Through the shared-equity program, the government contributes up to 40% for new homes and 30% for existing homes. Eligible buyers need only a 2% deposit to purchase and don’t have to pay lenders’ mortgage insurance. By reducing the size of the mortgage required, the scheme is designed to ease upfront costs and improve borrowing capacity for low- and middle-income households.

Over the next four years, up to 40,000 households are expected to access the scheme, with income thresholds set at $100,000 for individuals and $160,000 for couples and single parents. Property price caps in NSW are $1.3 million for capital city and regional centres, and $800,000 for other locations.

For many aspiring home buyers, particularly first home buyers and essential workers, Help to Buy offers another pathway into the property market at a time when deposits remain one of the biggest barriers to ownership.

About the author – Alex Veljancevski is a Sydney Mortgage Broker with Eventus Financial, which assists first home buyers, investors, upgraders and borrowers seeking to refinance to a better deal on their home loan.