Housing market gains momentum as rate cuts fuel buyer confidence

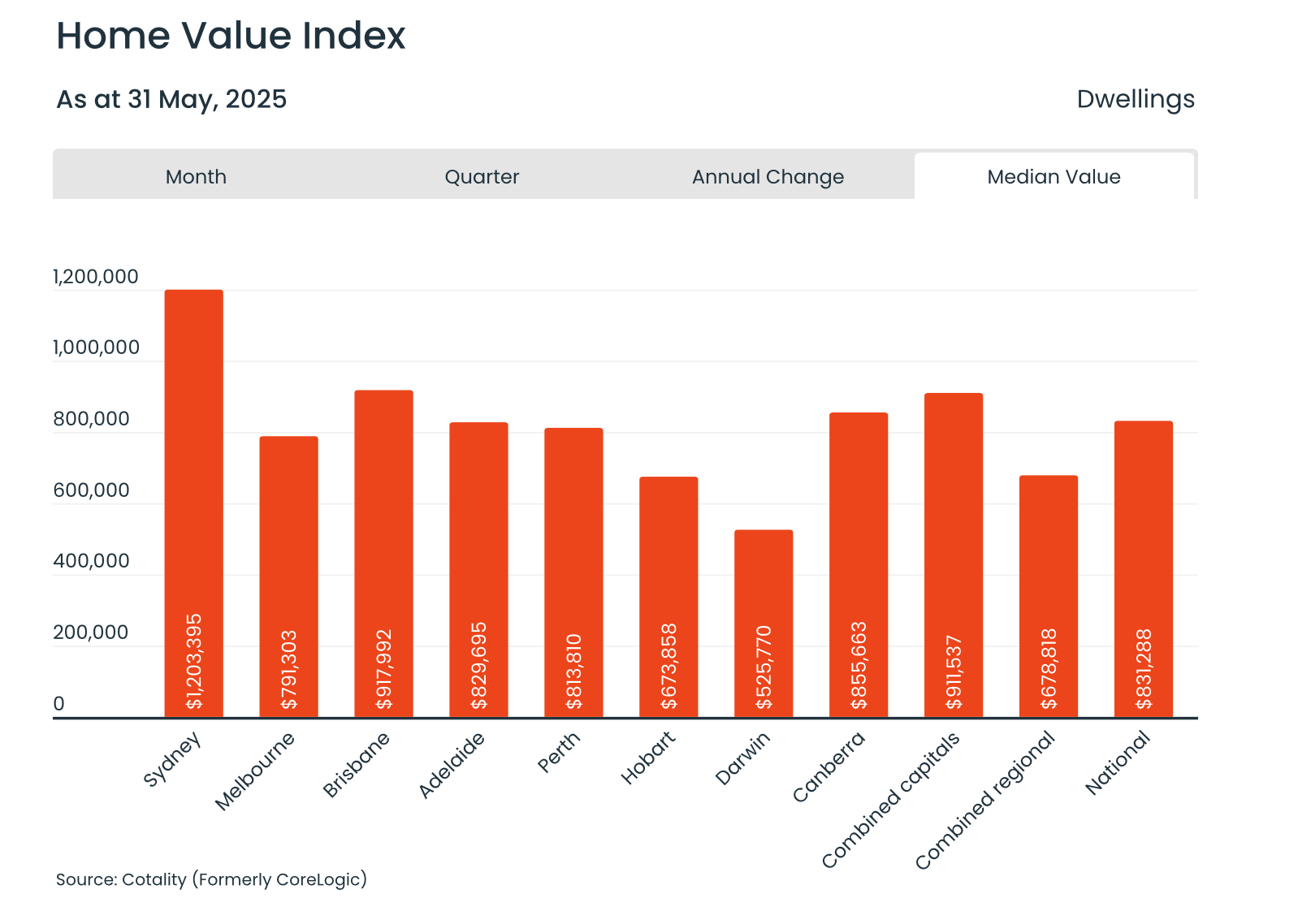

Dwelling values rose another 0.5% in May, according to Cotality’s (formerly CoreLogic) latest Home Value Index, taking national values 1.7% higher over the first five months of 2025.

Sydney property continues to show steady momentum, with dwelling values up 0.5% in May, and 1.1% over the last quarter. Sydney’s annual growth rate is sitting at 1.1%, with a median dwelling value currently at $1,200,000 – reaffirming its place as the country’s most expensive capital.

What’s driving the broad-based national gains? Ratecuts, both delivered and anticipated, are playing a major role. Buyer confidence has picked up, auction clearance rates have lifted and higher-end segments in Sydney and Canberra are now outperforming the lower quartiles – a reversal of last year’s trend.

Nationally, the market is also becoming more synchronised. The gap between the strongest and weakest-performing capitals has narrowed to just 9.8 percentage points, the smallest spread since March 2021 – suggesting more stable conditions across the board.

With further cuts expected later this year, we’re likely to see continued upward pressure on housing values. Lower borrowing costs improve affordability and boost buyer demand — both key drivers of price growth in property values.

About the author – Alex Veljancevski is a Sydney Mortgage Broker with Eventus Financial, which assists first home buyers, investors, upgraders and borrowers seeking to refinance to a better deal on their home loan.