Creative paths to home ownership amid soaring prices in Sydney

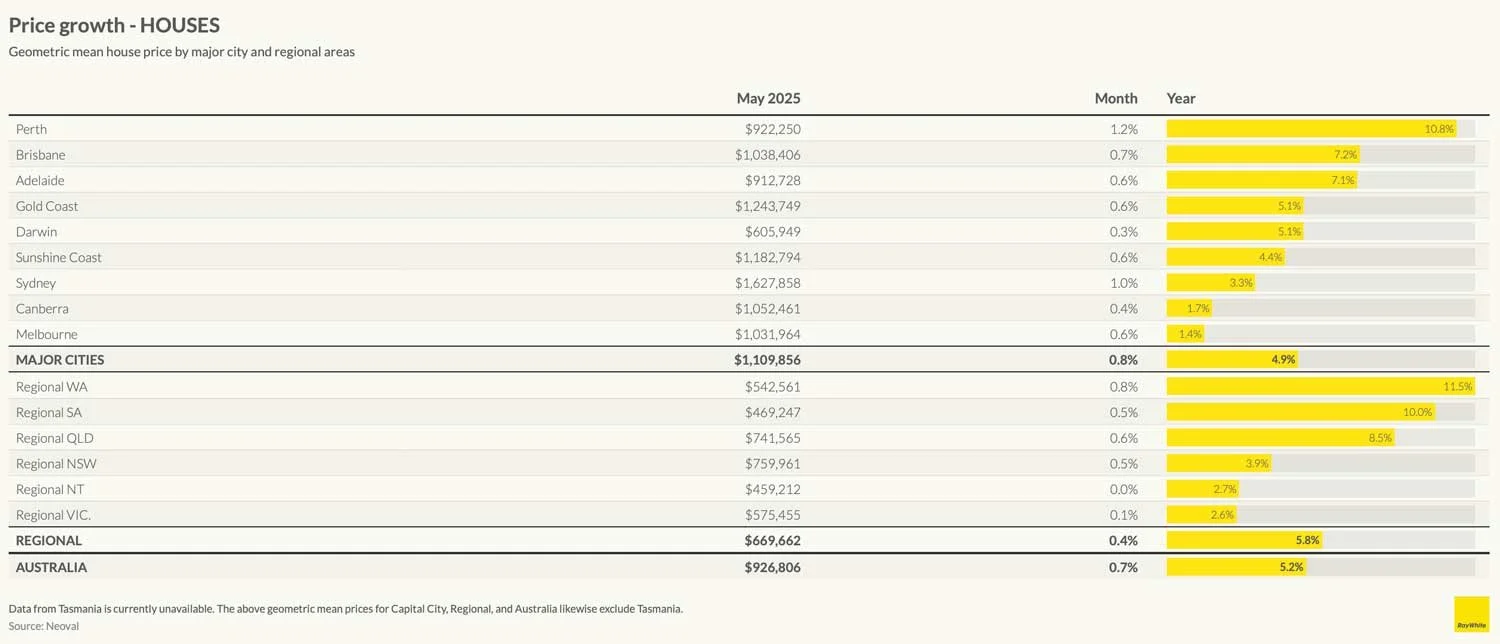

Buying a median-priced house in Sydney today requires earning 55% more than in March 2020, according to Canstar. With the city’s median price above $1.6 million and forecasts suggesting it could hit $2 million by the end of 2026 (Ray White, June 2025) — home ownership in the Sydney real estate market can feel increasingly out of reach.

But there are still ways in. Some buyers are taking alternative routes to enter the market, including:

Guarantor loans – which can help sidestep the typical 20% deposit

Paying lender’s mortgage insurance (LMI) – enabling earlier entry with a smaller deposit

Shifting focus to more affordable units

Adopting a rentvesting strategy — renting in a preferred suburb while buying in a more affordable location

If you're exploring property investment or need help navigating finance, working with a trusted mortgage broker like Eventus Financial can make all the difference.

About the author – Alex Veljancevski is a Sydney Mortgage Broker with Eventus Financial, which assists first home buyers, investors, upgraders and borrowers seeking to refinance to a better deal on their home loan.