Rentvesting on the rise as first home buyers shift strategy

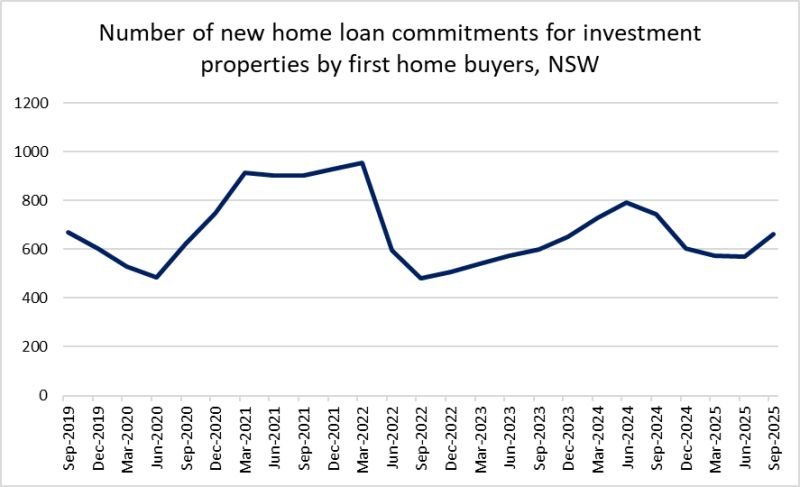

Rentvesting appears to be gaining real momentum in Sydney, with new data from the Australian Bureau of Statistics showing a sharp rise in first home buyers choosing to purchase investment properties instead of buying their own home.

In NSW, the number of first home buyers purchasing an investment property jumped 16% in the September quarter alone, signalling a clear shift in strategy.

Sydney’s median dwelling value price reached $1.26 million in October 2025, according to Cotality, putting owner-occupied homes out of reach for many first home buyers. On the other hand, rentvesting allows you to live where you want while buying where you can afford.

While investment properties don’t qualify for the 5% Government Deposit scheme, 2025’s interest rate environment after three rate cuts has boosted confidence.

For many first home buyers, rentvesting offers a practical path to getting on the ladder sooner while building long-term wealth.

About the author – Alex Veljancevski is a Sydney Mortgage Broker with Eventus Financial, which assists first home buyers, investors, upgraders and borrowers seeking to refinance to a better deal on their home loan.