RBA holds rates at 3.85% despite progress on inflation

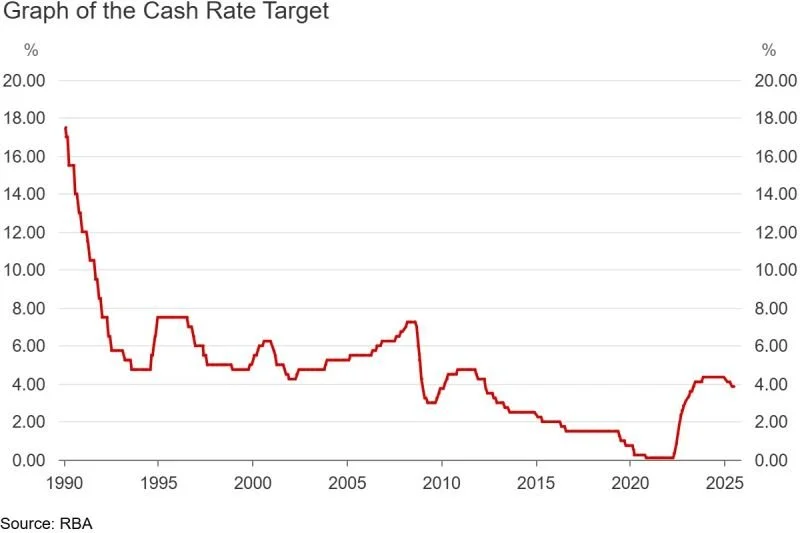

In a surprising move, the Reserve Bank of Australia (RBA) voted to hold the official interest rate at 3.85% at its July meeting.

This comes despite continued progress on inflation, which has now fallen to the midpoint of the RBA’s 2–3% target range.

While the RBA has already cut rates twice in five months, it said it was waiting for more evidence that inflation will stay sustainably under control.

The official June quarter inflation results are yet to be released, but recent monthly consumer price index data came in slightly stronger than the RBA expected, with annual trimmed mean inflation rising 2.4% in May, down from 2.8% the previous month.

Additionally, although labour market conditions remain tight, productivity growth is still weak and some sectors are reporting demand has not yet picked up, making it difficult for businesses to pass on cost increases to consumers, said the RBA in its statement on monetary policy.

Ongoing uncertainty in global economic conditions, particularly the lack of clarity on US tariffs and any resultant policy responses from other countries, also contributed to the board’s decision this month.

About the author – Alex Veljancevski is a Sydney Mortgage Broker with Eventus Financial, which assists first home buyers, investors, upgraders and borrowers seeking to refinance to a better deal on their home loan.