RBA holds cash rate at 3.60% as economic recovery strengthens

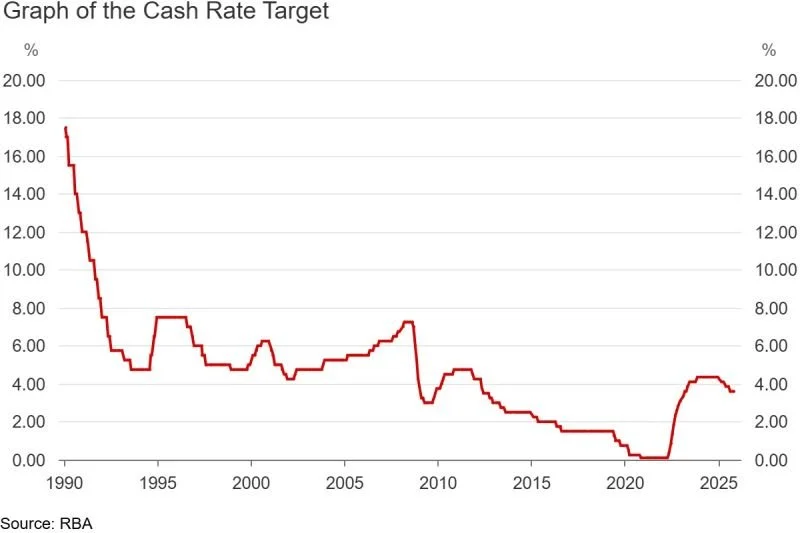

The Reserve Bank of Australia (RBA) has left the cash rate unchanged at 3.60%, holding steady as inflation remains persistent but the broader economy continues to improve.

In its statement following the November meeting, the RBA said recent data showed “the housing market is continuing to strengthen, a sign that recent interest rate reductions are having an effect”. It also noted that credit remains readily available to both households and businesses – welcome news for borrowers and homebuyers.

While inflation rose slightly in the September quarter, the Board believes part of this rise is temporary and expects inflation to return to its 2–3% target range over time.

With the economy stabilising, housing activity improving and borrowing conditions loosening over 2025, there are still positive signs that the recovery is gaining traction. The RBA’s own forecasts point to the cash rate easing to around 3.3% by the end of 2026.

About the author – Alex Veljancevski is a Sydney Mortgage Broker with Eventus Financial, which assists first home buyers, investors, upgraders and borrowers seeking to refinance to a better deal on their home loan.