Mortgage relief: Aussies start rebalancing budgets after rate cut

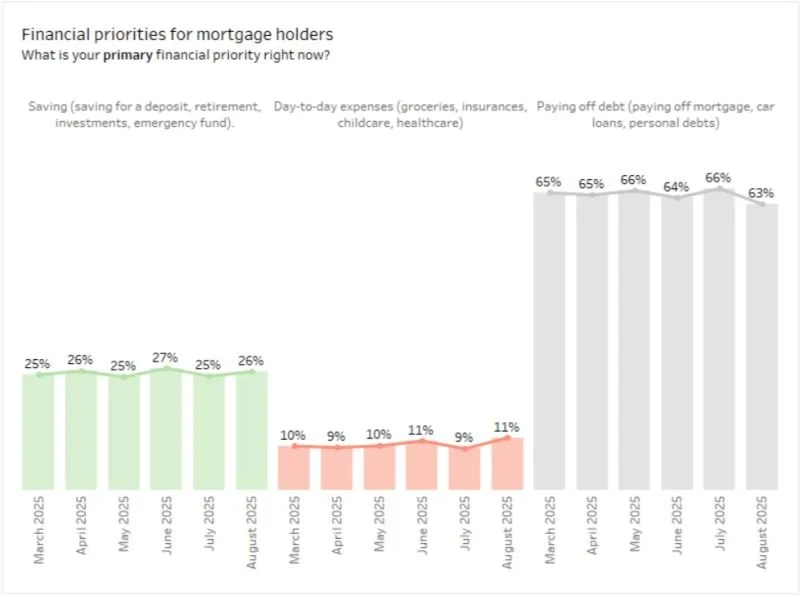

Agile Market Intelligence’s August 2025 Consumer Pulse survey reveals how mortgage holders are shifting their financial priorities after the August interest rate cut. While paying off debt remains the top priority, the pressure appears to be easing.

In August, 63% of mortgage holders said debt repayment was their main priority, down from 66% in July and the lowest since March. At the same time, 11% prioritised day-to-day expenses, up from 9% last month, while 26% focused on saving.

Michael Johnson, research director at Agile Market Intelligence, said: “Mortgage holders are still focused on reducing debt, but we’re starting to see signs of flexibility in their budgets. With rate cuts on the horizon, many are cautiously shifting attention toward household costs.”

Having extra cash for everyday expenses is welcome. But if your budget allows, consider keeping your home loan repayments at the pre-rate-cut level. Doing so could cut years off your loan and save thousands of dollars in total interest paid.

About the author – Alex Veljancevski is a Sydney Mortgage Broker with Eventus Financial, which assists first home buyers, investors, upgraders and borrowers seeking to refinance to a better deal on their home loan.