More first home buyers to benefit from 5% deposit scheme from October

Good news if you're trying to break into Sydney’s property market: from 1 October 2025, you could buy a home with just a 5% deposit and no lender’s mortgage insurance.

The federal government has fast-tracked its expanded Home Guarantee Scheme (HGS), removing income caps and lifting price thresholds to reflect today’s market conditions. That means more first home buyers can get in sooner – with less deposit, less stress and fewer upfront costs.

What’s changing in the HGS?

From October, the scheme will:

Remove the cap on the number of places

Scrap income limits

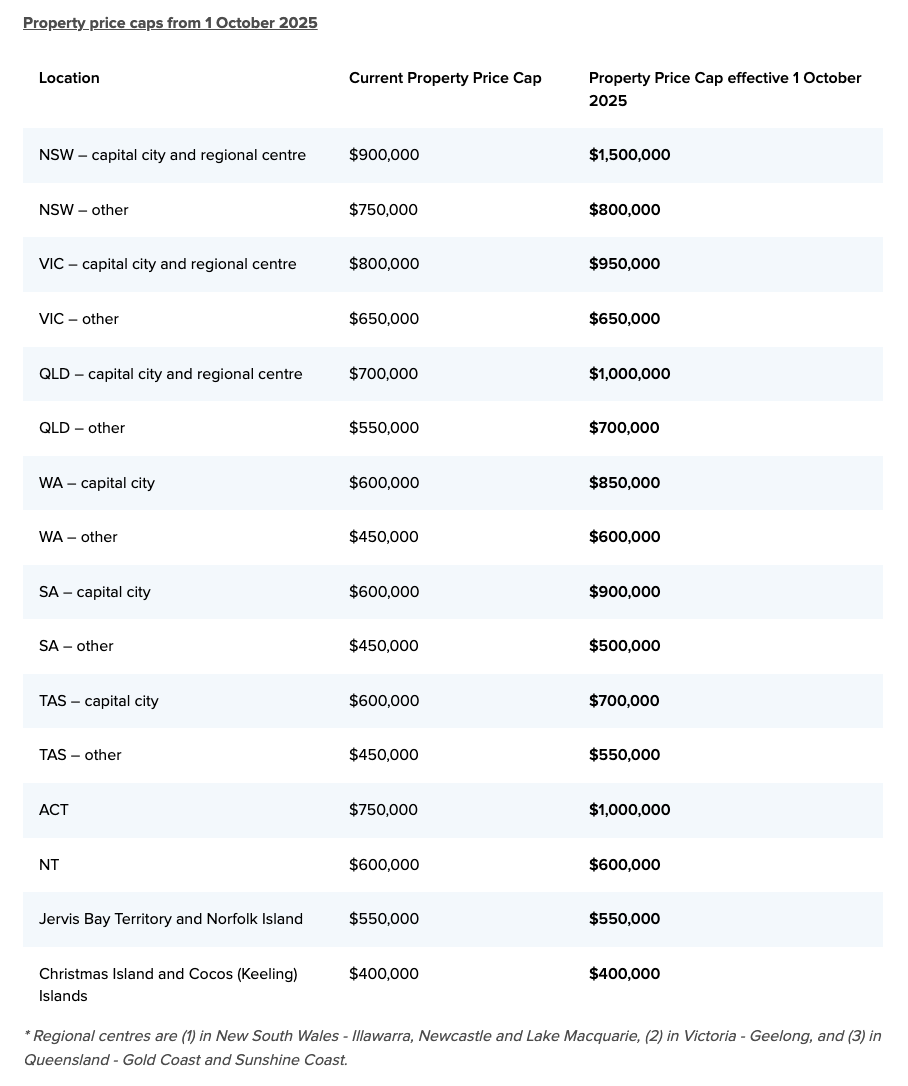

Raise property price thresholds to:

$1.5 million in Sydney

$950,000 in Melbourne

$1 million in Brisbane and the ACT

It’s a significant shift, designed to open doors for more Australians chasing the dream of home ownership.

What does this mean for buyers?

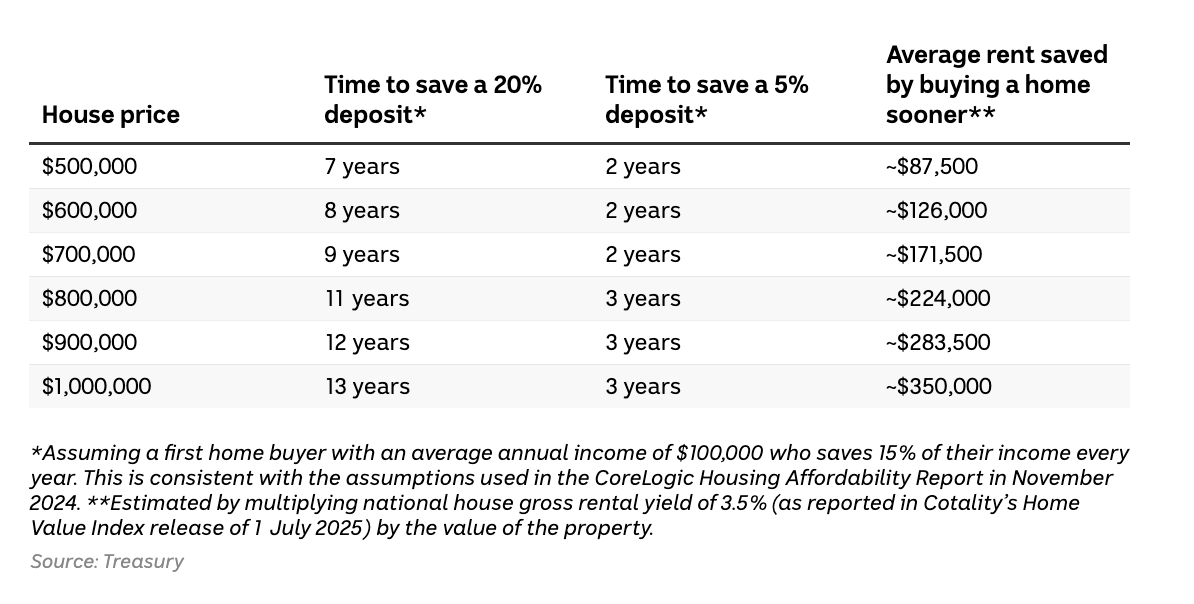

Put simply, it could get you into your first home years sooner– and save you thousands in the process.

For example, in Sydney, the previous property price cap for the Home Guarantee Scheme was $900,000. Under the new rules, this cap rises to $1.5 million, meaning a buyer could now purchase a $1.5 million property with just a 5% deposit – around $75,000 – instead of needing a much larger deposit to meet the old cap. Add in the savings on lender’s mortgage insurance and potential stamp duty concessions, and the total benefit could exceed $34,000.

Treasury expects 20,000 more people will access the scheme in the first year alone. And because they’re able to stop renting and buy sooner, those buyers could also save tens of thousands of dollars in rent (see below).

“We want to help young people and first home buyers achieve the dream of home ownership sooner. Bringing the start date of our 5 per cent deposit scheme forward will do just that,” Prime Minister Anthony Albanese said in a statement.

More lenders, more choice

To make the scheme even more accessible, the government has asked Housing Australia to broaden its lender panel, including customer-owned banks and credit unions. Currently, the scheme is available through more than 30 lenders.

How can a mortgage broker help?

A mortgage broker can guide you through the expanded HGS, including checking your eligibility, explaining deposit and property caps, and comparing lenders. We’ll also help with pre-approval and paperwork, and show you how to maximise the benefits, such as stamp duty exemptions or waived insurance costs.

With expanded support and fewer restrictions, now’s the time to explore your options.

With new deposit support coming, now’s the time to explore your options. Sydney’s award-winning broker with 440 five-star Google reviews, Eventus Financial. Book a consultation with Alex today.